BRISBANE, Thursday 15 February 2024: Australian business technology solutions leader Data#3 Limited (ASX: DTL) today announces its results for the six months ended 31 December 2023 (1H FY24). The Company delivered further growth in its underlying business against a particularly strong first half FY23 and benefited from substantial interest income.

Commenting on the 1H FY24 result, Data#3 Chief Executive Officer and Managing Director Laurence Baynham said: “We are pleased with the first half performance, reporting a record half year NPAT of $21.4 million, an increase of 25% on 1H of FY23, which was unusually high having grown 38% on 1H FY22. The record result reflects good contributions across most of our business units and regions, with company Gross Sales growth over double industry growth rates. Our Services and Software Solutions businesses performed ahead of expectations, with 67% of Gross Sales now recurring. Although our Infrastructure Solutions business was up on the prior period, it was impacted by customers previously ordering in advance of requirements, in response to pandemic related supply chain issues. This slowed down ordering and decision making in the current period. Improved supply chain conditions reduced our stock levels, and our diligent management of working capital enabled us to benefit from increased interest income of $6.5 million.”

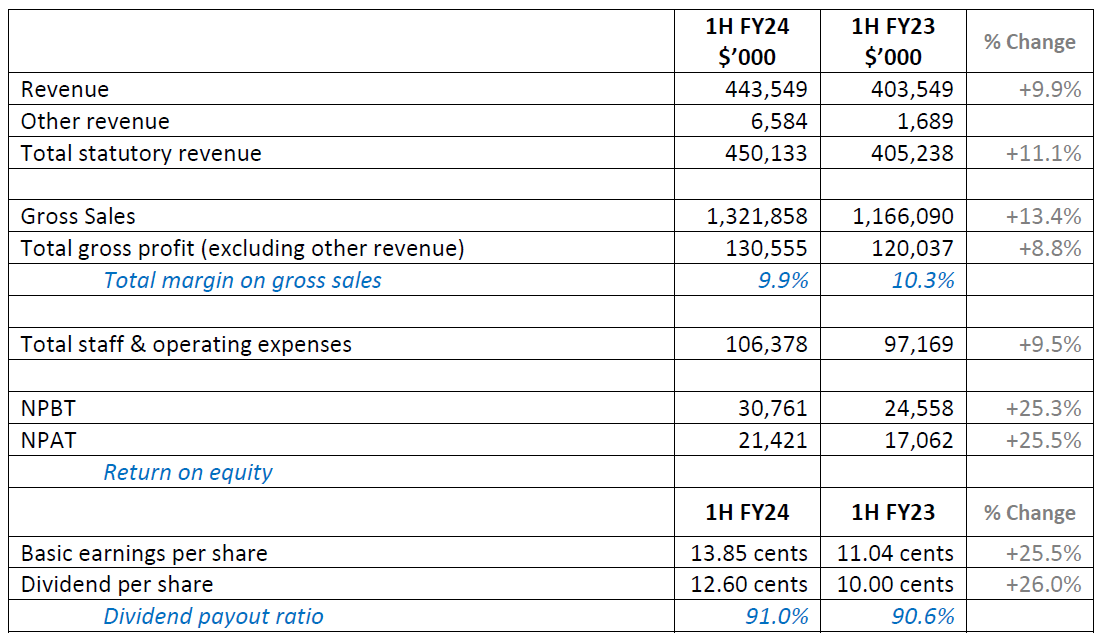

Total Gross Sales increased by 13.4% to $1.32 billion, more than double the expected 2023 market growth rate of 5.8%1, with substantial multi-cloud (public and private cloud) growth. Multi-cloud solutions are reflected across each of our business units and provide greater opportunities for our service offerings. The consolidated net profit before tax increased by 25.3% to $30.8 million and consolidated net profit after tax increased by 25.5% to $21.4 million. Basic earnings per share increased by 25.5% to 13.85 cents.

During the first half, the Company undertook a detailed review of its software licensing agreements to reassess whether the Company is acting as a principal or agent under these agreements. This was in response to updated guidance released for software resellers in 2022 on the application of the revenue accounting standard (AASB 15). The review resulted in a change to the Company’s revenue accounting policy to present software licensing revenues on a net basis, including a restatement of comparatives. This is a statutory presentation change only, and the Company will continue to measure its operational performance in terms of Gross Sales, with both Gross Sales and statutory revenue to be reported to ensure comparability with historical reporting and to align with how the company internally measures performance.

The Company’s non-financial measures indicate the underlying health of the business has continued to strengthen. Staff and customer satisfaction surveys produced record results, and Data#3 succeeded in winning a cross-industry Employer of Choice award for the ninth year in a row. The Company has continued to be recognised by many of its global partners with national and international awards.

The directors have declared a fully franked interim dividend of 12.60 cents per share. This represents an increase of 26% on the previous corresponding period and a payout ratio of 91%. The interim dividend will be paid on 28 March 2024, with a record date of 14 March 2024.

The group’s performance continues to be underpinned by its leading market position, unrivalled vendor relationships and large, long-term customer base serviced by a highly experienced and skilled Data#3 team.

Data#3 Chief Executive Officer and Managing Director Mr Baynham said: “We expect technology, and specifically digital transformation combined with artificial intelligence, to play a leading role in Australia’s economic future. Although we are seeing some delays in customer decision making, we are also seeing increased tender activity which should support growing our pipeline.”

“Consistent with previous practice, we are unable to provide specific FY24 guidance at this stage. In line with previous years, we continue to expect a sales peak in the months of May and June, and our goal remains to continue to deliver sustainable earnings growth.”

As announced at the AGM on 31 October 2023, Laurence Baynham will retire from his CEO/MD role on March 1st 2024. The four-month transition is nearing completion and Brad Colledge will take over as CEO. Brad joined the business in 1995. Chairman Mr Mark Gray said: “On behalf of the Board, I’d like to thank Laurence for his outstanding leadership over almost 30 years, which has contributed significantly to the ongoing success of the Company. We wish him every success in his future endeavours.”

The company will present a market briefing on the results starting at 10:00am (AEST) today, 15 February 2024.

The following URL will provide access to the live event, and to an archived webcast following the event: https://webcast.openbriefing.com/dtl-hyr-2024/.