Download Customer Story Contact Us

Objective

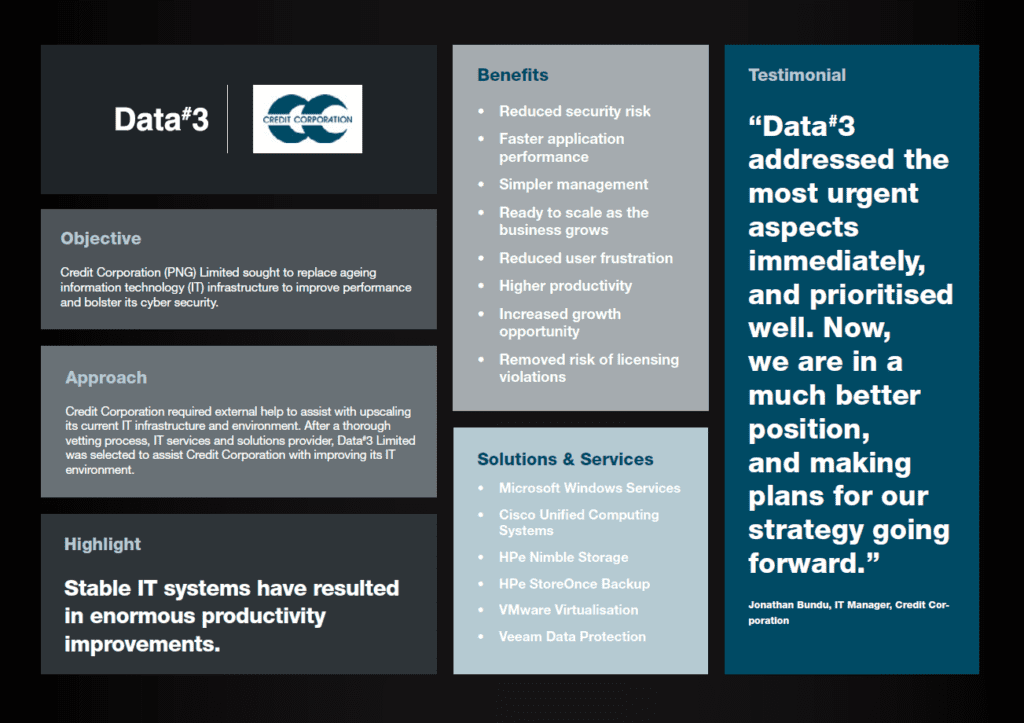

Credit Corporation (PNG) Limited sought to replace ageing information technology (IT) infrastructure to improve performance and bolster its cyber security.

Approach

Credit Corporation required external help to assist with upscaling its current IT infrastructure and environment. After a thorough vetting process, IT services and solutions provider, Data#3 Limited was selected to assist Credit Corporation with improving its IT environment.

IT Outcome

Business Outcome

Project Highlight

Stable IT systems have resulted in enormous productivity improvements.

Data#3 addressed the most urgent aspects immediately and prioritised well. Now, we are in a much better position, and making plans for our strategy going forward.

Jonathan Bundu – IT Manager, Credit Corporation

The Background

Credit Corporation (PNG) Limited commenced business in 1978 as a general finance company and over the past 42 years has grown to become one of the South Pacific’s most progressive financial institutions.

Currently, the Group operates offices in five countries within the South Pacific region and helps retail and business customers with financial solutions to suit every stage of their journeys.

Credit Corporations IT environment included a piecemeal/fragmented range of equipment from many/a variety of vendors and lacked cohesion. There was little visibility of the licensing situation, and management was difficult. Poor application performance meant users were frustrated, and growth opportunities limited.

The Challenge

A range of IT software and infrastructure have been added over the years to meet the business’s needs of Credit Corporation. Consequently, the business had an ageing IT infrastructure, with poor integration, and restricted visibility, meaning Credit Corporation’s IT team was put onto a responsive footing. When Credit Corporation IT Manager, Jonathan Bundu joined the business, his priority was to stabilise the situation, and introduce core IT infrastructure that would provide the basis for digital transformation.

“When I came on board in 2019, the Credit Corp management team was keen to achieve more with our technology investment. Some legacy systems were due for replacement, and we wanted to make sure we invested in the right licensing options to ensure that our environment was fully supported for the future. This prompted us to source a new infrastructure model,” outlined Bundu.

Credit Corp knew that a new IT strategy and roadmap would pave the way for future growth with modern technology making it easier for staff to collaborate and provide more efficient services to their loyal customers.

“We didn’t want to miss this opportunity to raise the productivity and efficiency of our teams, and with access to the right core technologies, we could increase the speed at which our teams could connect to systems. The increased demands on storage, due to increasing volumes of data, affected the speed of our systems, which in turn impacted front-line users. Our team was very keen to embrace modern, efficient technologies that could help us to provide the best service that we pride ourselves on,” said Bundu.

Like most financial institutions, security needed to be a prime consideration for Credit Corp. Legacy system hardware is not always suited to today’s cyber risks and can restrict protection. The complexity also makes it challenging and time consuming to document security policies, processes, and system configurations, while newer technologies give far greater visibility. Bundu also identified that backup systems could be improved, so that data could be retrieved faster and with less effort.

“Because the security landscape constantly changes, businesses must always monitor for new vulnerabilities. Like every organisation, we must consider ourselves a target for cybercriminals, and our executives took the responsible step of prioritising expenditure to ensure we had a secure environment designed to protect against constantly evolving threats,” recounted Bundu.

“We knew external expertise would be valuable, so we had a look at local providers. We knew what Data#3 was capable of, so we invited them to help us.”

IT Outcome

A key recommendation from Data#3 was to first take remediation action to stabilise the IT systems already in use. This would minimise risk and disruption as the new environment was put in place. As part of this process, all Microsoft Windows Servers were upgraded, and a security report was produced by Data#3’s consulting arm, Business Aspect, a wholly owned subsidiary.

“They worked with us on identifying the root areas that were causing system issues and helped us to fix what we could at that time. We worked on a roadmap to get our systems into a stable, scalable state,” described Bundu.

Bundu said that he scrutinised the proposed solution from Data#3 carefully, challenging the team to demonstrate that every part of the plan could be fully justified.

“We took a critical look, so we understood the logic behind each recommendation, and how it met our business priorities. It all made logical sense, which made it easy to position to the board and executives.”

Those recommendations included a full upgrade of core systems infrastructure at the Credit Corporation head office and disaster recovery site, chosen for a combination of robust security, high performance, and ability to scale. Based on Cisco Unified Computing System servers and HPE Nimble Storage, with HPE StoreOnce backup storage, the solution gave Credit Corporation the dependable/stable core IT infrastructure needed as the business continues to grow. Virtualisation capabilities were provided by VMware, easing the management of the Credit Corporation IT environment, while Veeam was chosen to offer superior data protection.

“I liked the scalability and security around the whole proposal. This was a critical area, and we needed to address backups, data protections, and offsite disaster recovery. Going down the path of Cisco, and using HPE storage infrastructure, meant that in the event our business has the chance to grow, the solution is scalable. Previously, we had a variety of different systems, which was harder to manage, and by bringing it all together, updating software and hardware is made more manageable,” explained Bundu.

Despite careful planning, travel restrictions due to the COVID-19 pandemic meant that the Credit Corporation IT team and Data#3 team now had to revise and adjust their collaborative efforts to ensure the project’s successful execution.

“By then, COVID-19 was here, and we had restrictions, the initial plan to have equipment sent over, and experts on-site for deployment didn’t eventuate. We had to be more creative; the guys from Data#3 did the setup in Australia, documented everything that needed to be done, and where everything should go, we had couple of sessions to prepare, and shipments were sent across to PNG, Vanuatu, and Fiji. Once here, our team provided remote connectivity to the Data#3 experts, and they guided us through,” recounted Bundu.

With the solution in place, the Credit Corporation IT environment is stable, and managing the day-to-day is far easier. Much of the ongoing monitoring is handled by Data#3, with the Credit Corporation IT team managing the day-to-day with the help of the detailed documentation now in place.

“Data#3’s biggest strength was undoubtedly their skillset, their expertise, and the shared knowledge of their solutions was second to none. I have worked with teams previously, and some of these things took years to implement, but these guys took just days to remediate vulnerable apps and put in solutions. Their rapid pace really stood out,” said Bundu.

Business Outcome

Given the rise in cybercrime that has emerged during the COVID-19 pandemic, Credit Corporation benefits from the bolstered security of its new core IT infrastructure. The risk of data loss has also been addressed with the introduction of a dependable data protection solution. Another significant risk eliminated, was incorrectly licensed software, which can result in considerable penalties.

The stability of the IT environment, however, has resulted in the greatest transformation. Applications now run smoothly, with reports running up to 200% faster, and an increase in user productivity.

“For our users, productivity has leapt hugely. People must sit back and remember what it was like before, because right now everything works, which is one of the biggest achievements. We don’t have so many complaints about system issues, our systems are stable, with regular monitoring,” said Bundu.

Credit Corporation now has an IT environment that supports user efficiency, which in turn reduces IT support needs/requests. This provides the Credit Corporation IT team with the opportunity to take a proactive approach in meeting users’ needs and planning future enhancements that will keep Credit Corporation ahead of its competitors.

As governments and communities plan their path out of the COVID-19 restrictions, Bundu sees Credit Corporations role as essential to helping businesses get back on their feet.

“It was a bit different, dealing with the various lockdowns and bubbles, and the business impact on tourism-driven economies has been huge. Our management knew something needed to be done and we used the downtime to prepare our systems, to get everything stabilised, so that when business picked up, we would have the right platforms to play our part in recovery.”

Conclusion

The experience of completing a major project during a time of global upheaval has validated Bundu’s belief that both strong expertise and the right partnership are crucial. While his team is experienced at dealing with challenges involving logistical challenges and internet disruptions, he said it was necessary to seek help from external IT partners such as Data# 3 when completing crucial IT projects.

“The team was awesome, the expertise the guys had was good. They had patience with us, knowing we didn’t have the same skill set they did, and they documented everything to guide us through. They held our hand most of the way,” recounted Bundu.

The logical approach and prioritisation, based on Credit Corporation’s most immediate business needs, passed Bundu’s scrutiny, and he recommends challenging IT partners to demonstrate this level of examination.

“Data#3 addressed the most urgent aspects immediately and prioritised well. Now, we are in a much better position, and making plans for our strategy going forward.”