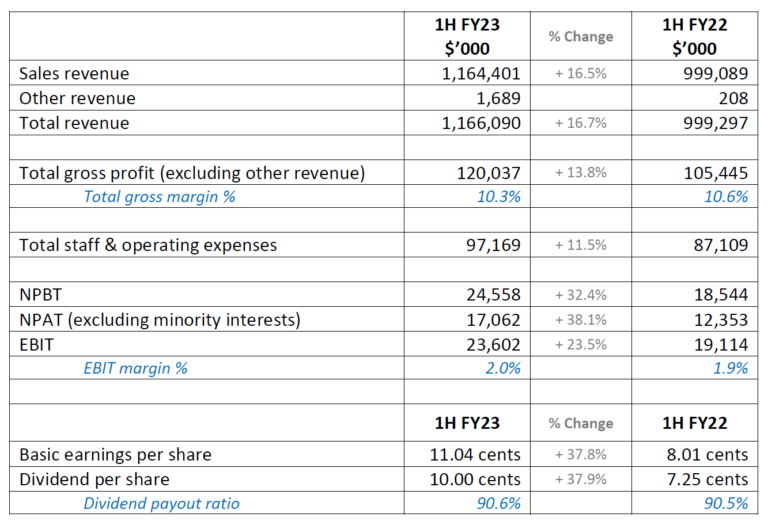

1H FY23 Highlights:

• Revenue up 16.7% to $1,166.1 million

• Gross profit up 13.8% to $120.0 million

• NPBT up 32.4% to $24.6 million

• NPAT up 38.1% to $17.1 million

• Basic EPS up 37.8% to 11.04 cents per share

• Interim fully franked dividend up 37.9% to 10.00 cents per share

• Strong balance sheet with no borrowings

Commenting on the 1H FY23 result, Data#3 Chief Executive Officer and Managing Director Laurence Baynham said: “We are very pleased with the strong first half performance, which saw solid contributions across our business units and regions. This was underpinned by particularly strong growth in our software and infrastructure businesses, reflecting momentum in our large integration projects, as well as good execution of our strategy to grow our services businesses and recurring revenue base. We continue to manage costs well and drive operating leverage, while still investing in growth.”

Total revenue increased by 16.7% to $1.17 billion, with substantial multi-cloud (public and private cloud) growth. This provides greater opportunities for our service offerings and essential data for the solutions we provide to our customers. Growth in the cloud business is a major competitive advantage as it provides essential data for the solutions provided to Data#3’s customers.

Contracts with Government and large corporate customers also delivered recurring revenues of approximately 65% of total revenue, in line with the previous corresponding period (PCP), as we deliberately pursue growth in services.

Data#3 grew gross profit 13.8% to $120 million with overall gross margins slightly lower at 10.3%, due to the Company’s much larger but lower-margin infrastructure solutions and software solutions businesses growing more than 18%.

Consolidated net profit before tax (NPBT) increased by 32.4% to $24.6 million, demonstrating continued improvements in operating leverage. This was consistent with the guidance provided on 17 January 2023. The consolidated net profit after tax (NPAT) increased by 38.1% to $17.1 million and basic earnings per share increased by 37.8% to 11.04 cents.

While the FY22 backlog caused by the global shortage of computer chips and integrated circuits and supply chain delays provided a fast start to FY23, the group experienced a similar backlog at the end of December due to an increased volume of business. The overall impact on the first half result was therefore not material, underlining the strength of the result. Data#3 has experienced some improvement in supply chain conditions over the half and continues to manage any shortages and delays with early ordering.

The company has continued to increase headcount, predominantly in its growing services teams. This ability to attract and retain talent in a highly competitive industry reflects the company’s leading market position and attractiveness as a place to work. In addition, the company continues to benefit from having a specialist recruitment business, Data#3 People Solutions, which presents a key differentiator in the market.

Data#3 continues to be highly regarded by its global vendor partners with recent national and international awards including Cisco Global Security Partner of the Year, Microsoft Global Device Reseller Partner of the Year, HP Services Partner of the Year, Dell Technologies Channel Services Delivery Excellence Partner Award, Aruba as a Service Partner of the Year and Palo Alto Networks Security Growth Partner of the Year.

The directors declared a fully franked interim dividend of 10.00 cents per share. This represents an increase of 37.9% and a payout ratio of 90.6%. The interim dividend will be paid on 31 March 2023, with a record date of 17 March 2023.

We are well positioned to capitalise on a growing market and industry tailwinds, in particular the opportunities for software and services.

Mr Baynham added: “Our strong customer base and close alignment with global vendors puts us in a strong position to further cement our market leadership in a rapidly growing Australian IT market. The pipeline of large integration project opportunities continues to build as large corporates and government bodies drive transformation agendas. Meanwhile our strategic focus on services growth remains an integral part of our software and infrastructure offering, while further improving our margins.”

“At this stage it would not be prudent to provide specific guidance for FY23. In line with previous years, we continue to expect a sales peak in the months of May and June and a profit skew in the second half. Our goal remains to deliver sustainable earnings growth.”

Management will host a market briefing at 10:30am (AEDT). The following URL will provide access to the live briefing, and to an archived webcast following the event:

https://webcast.openbriefing.com/dtl-ir-160223/